Let’s talk about popular proof of stake cryptocurrencies today…

And I know one more important question that might cross your mind would be:-Why proof of stake cryptocurrencies? Why should one know them? What’s so special about them?

So to answer such questions, let’s get started…

Proof of stake (aka POS) cryptos have many technical benefits, but apart from that, some proof of stake cryptos also give different economic benefits/dividends to their HODLers by giving them the option of running a masternode or staking their coins in a stake-able wallet.

Simply put into perspective i.e you can earn by just holding many POS cryptocurrencies.

This provides dual benefits of securing the blockchain network and creating an opportunity for users to get incentives or dividends on their holdings.

I have already written in detail about the distributed proof of stake (POS) cryptocurrencies and their consensus mechanism in my previous article, which you can read here.

But for the newcomers, let me explain what distributed consensus and POS is:

Distributed consensus simply means a large pool of people who are geographically segregated agreeing on something. In cryptocurrencies like Bitcoin, ‘something’ here means agreeing on which transactions or blocks are valid and which are invalid to be added/rejected to the blockchain.

AND

Proof of stake is a typical computer algorithm through which some cryptocurrencies achieve their distributed consensus. It is also a better alternative to the proof of work algorithm by achieving the same distributed consensus at a lower cost and in a more energy efficient way. (For more details on POS vs POW read here)

So if you are holding any such POS cryptocurrencies, then I think you should know how to start earning dividends by staking them in the right wallets.

And if you are not holding any such POS currencies, then you should start looking into them, as they can be an excellent source of smart passive income.

Update: November 2022

Binance which is the world’s biggest cryptocurrency exchange has added a staking feature which in my opinion, is the best way to find profitable proof of stake coins. However, you should know that staking returns offered by exchanges are less than direct staking. The benefit is you can redeem quickly, and you don’t have to dabble with tech know-how.

Here is how to access it:

- Login to your Binance account or create one if you don’t have

- Click on Earn > Stake

Here you will see a list of supported proof of stake coins along with the Estimated Annual yield and minimum holdings required. You can click on Deposit and start staking these POS coins.

As technology is evolving, this has become one of the easiest and fastest ways to stake coins and earn profit.

For starters, here is a list of the best POS cryptocurrencies…

Page Contents

Top 7 Profitable Proof Of Stake Cryptos

1. ETH 2.0 (5-7%)

Ethereum is not the most profitable yet most popular proof of stake coin.

Ethereum network is the most used and in-demand blockchain network at the moment. More than 2800 Decentralized Applications are built on it, clogging the network, and there is an urgent need to scale it.

Ethereum is currently a Proof of Work (PoW) network, and to solve its scalability issues, it is scheduled for its next big update, i.e., Ethereum 2.0, which would convert it into a Proof of Stake network. This would optimally scale and secure the network and allow the building of more innovative Decentralized Applications.

ETH (Ether) is the native token of the Ethereum Network. Although the final merge of Ethereum 2.0 is yet to happen, the Beacon Chain of the Ethereum 2.0 was launched in December 2020, and ETH holders can stake their tokens on the network.

You can stake your ETH directly on the network by becoming a node operator. For this, you need 32ETH or more and should have the technical capabilities to run a node on the network. The problem with this is that there is a long waiting list for prospective node operators. Further, the staked ETH cannot be unstacked till the Ethereum 2.0 merge is complete.

The easier way is to stake your ETH with staking service providers who have their node operators and take a portion of your staking rewards as a fee. Some service providers also allow you flexible staking, which means you can unstake your funds anytime.

Hence, there are predominantly three ways to Stake your ETH

- Become a node operator on the network

- Use centralized Ethereum staking service providers such as Coinbase, Kraken, and Binance

- Use a decentralized staking service provider such as Lido Finance

Please note that choosing the right staking platform is necessary for the following reasons:

- If a node operator misbehaves in any way, then a part of ETH staked by him would be confiscated by the network. This is known as Slashing Penalties.

- The node operators would transfer these penalties to you. Some service providers, such as Lido Finance, have insurance against slashing penalties.

- Centralized staking services are custodial, i.e., these platforms have full custody of your funds. This means that if there is a hack on the platform, you may lose all your funds.

- Decentralized staking services are built on smart contracts and are, therefore, prone to smart-contract hacks.

- Some staking platforms have a lock-in period after unstacking before these funds are available to you.

So, you can choose any staking service that suits you. For beginners, Centralized staking services are suggested as they are pretty easy to use. However, I use Lido Finance for staking my ETH as it is decentralized, safe, and provides the benefits mentioned in the following video.

2. BNB (Up to 30%)

BNB is the native coin of popular exchange Binance. There are multiple ways by which you can stake BNB coin and earn up to 30% or more by staking alone.

The most popular way is by using BNB Vault which is available inside Binance exchange. You can find the BNB vault staking page directly here.

Another way to stake BNB is by using the Trust wallet, which is a popular mobile wallet. Though I’m not a huge fan of it, as the security of the mobile wallets is not rock-solid in comparison with hardware wallets. However, if you understand the risk and reward of a mobile wallet, you can use the Trust wallet to stake your coin.

Here is a video that explains what staking is, and how to stake BNB token on Trust wallet:

BNB token is available on multiple exchanges, some of the most popular websites to get BNB tokens are:

- Binance

- WazirX (For Indian netizens)

- Binance.us (For USA citizens)

3. Flow Token

Flow is an independent Layer 1 blockchain for games and NFT. You can stake Flow token using 3 methods, and I have highlighted them in the video below:

You can get Flow token on:

4. Akash Network (AKT token)

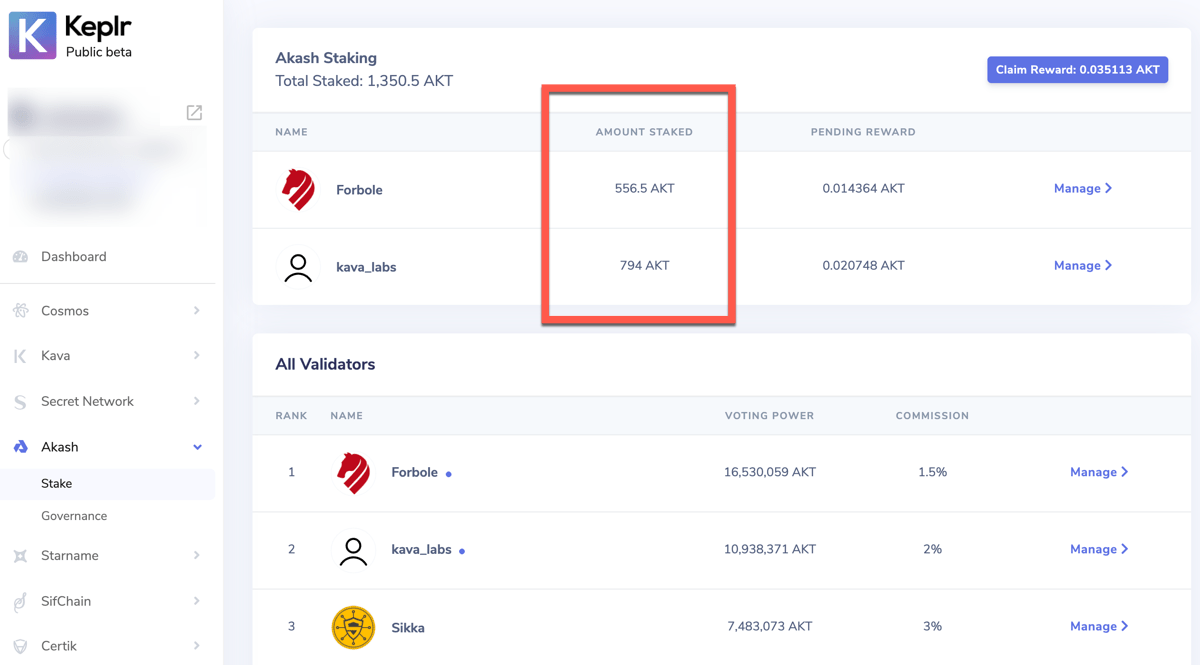

Akash Network is a proof-of-stake chain, built on Cosmos Hub, that leverages Akash Token (AKT), a native utility token, to govern, secure the blockchain, and provide a store and exchange of value. You can stake Akash (AKT) token to earn up to 58% APR. Unlike other proof of stake tokens, this offers one of the highest staking rewards.

You can use the Keplr wallet to stake your AKT token. You can get AKT token from:

5. Tezos

Tezos is a multi purpose blockchain with on-chain governance. By Staking (Baking) Tezoz (XTZ), you will be able to earn passive income.

Tezos is also the first proof of stake cryptocurrency that is supported by all major exchanges for staking. In fact, it is seen as a paradigm shift that now exchanges are offering crypto staking lately.

Tezos can be staked easily using any of the below-mentioned methods:

The easiest way for staking Tezos is by using Binance. They are the only one that offers zero fees staking and all you need to do is, just hold the coin in your Binance wallet. It is perfect for traders and investors.

- Ticker Symbol – XTZ

- Annual Return – Approx 6.8%

- Staking Wallet – Binance

You can get Tezos (XTZ) from Binance (Global) or CoinBase (USA).

6. Decentral Games ($DG)

$DG is an ERC20 governance token awarded to community members who provide value to the decentral.games ecosystem, such as playing games, providing liquidity, participating in governance, and referring new players. There will never be more than 1 million $DG.

At the time of writing this resource, you can earn up to 32% APY by staking $DG.

7. NOW

NOW token is a native cryptocurrency of an instant crypto exchange ChangeNOW. It was issued in 2018 and serves as an internal currency on NOW products. The token was issued as an ERC20 token, but now it also exists on Binance Chain (BEP2 Standard). In 2020 it has introduced NOW Staking as a way of profit from holding NOW tokens.

NOW Staking offers up to 25% in yearly interest, making it one of the tokens with the highest expected return.

There is a progressive reward scale in place, meaning that it gradually increases with time. If you hold NOW token for a week – you’ll get a 5% reward after a month it increases to 10% and reaches 25% in a year. ChangeNOW has an informative reward calculator to approximate your profits during a staking period.

The minimal amount of NOW tokens to begin staking is 10 NOW, and after one week, the reward starts to build up. The user needs to send the ‘Freeze’ transaction to the network, and from the moment it goes through, the staking is on. This can be done with special tools, like Token Freezer by BEPTOOLS, or with a wallet with such functionality, like Guarda.

The percentage of rewards is calculated and granted to stakeholders every week. To protect participants from whales, the maximal stake is limited to 100,000 NOW. However, if you have less than 100,000 and want to add more tokens, you can do so without resetting your accumulated reward multiplier. To balance out the inflation, after every 1,500,000 NOW distributed the token reward halving occurs, reducing inflation and increasing demand.

My Thoughts On Crypto Staking

November 2022 update: The implosion of Luna, FTT, and also sort of SOL has taught us that staking may not be the best option for passive income. There are multiple risks associated with it, which are beyond the smart contract risk.

Moreover, more of the staking platform requires you to lock your token for a specific amount of time, and this could result in a complete loss of your funds. We have seen this with Luna in 2022, and FTT in the last quarter of 2022.

IMO, you are better off now using the staking feature. However, as an education platform, we shared some of the best staking coins, but I let you decide if you want to go this route.

Also, when I think of negative and zero interest rates in some countries like the US, then cryptocurrency staking is much more profitable.

So let me know if you’re staking anything and what your favorite POS coin is. Let me hear your thoughts in the comments below!

Here are a few suggested things to read next:

- Ethereum Cryptocurrency: Everything A Beginner Needs To Know

- When To Use A Bitcoin/Altcoin Mobile Wallet?

If you liked this post, then do share it with your network!

I stake Potcoin (POT). The organization is a collaboration of farmers who grow medicinal marijuana in Canada. Since Canada is working on legislation for dispensaries, it makes sense to invest in the legal growers and the bonus is Potcoin is a staking coin. Trade for it and watch your wallet grow!

Decred should be added to that list! DCR is listed #40 in market cap (undervalued). Currently you can make around 18% per year mining it. Decred is also the first crypto to developed a hybrid PoW-PoS. In which, Ethereum wants to implement. For more information visit: http://www.decred.org.

Sure, think the same way as you. Is it stakable on a pi?

I cant believe you haven’t mentioned Bitbay!

Bitbay staking is offering a 5% return and has an extremely active development team with some extremely interesting features including decentralized web marketplace and rolling peg due for release in Q2 2018.

https://bitbay.market/

https://coinmarketcap.com/currencies/bitbay/

Wasn’t it 1 % before?

Are any of these coins ok to stake in your own wallet? As opposed to a pool. I know some coins are hard to stake on your own due to staking pools having large wallets.

Forgotten neblio, 10 % pos rewards a year.. Only thing you have to do, buy them and store them on your ntp1 wallet. Atm there are more then 5 companies running on the neblio blockchain and only has a market cap of 60 million. Huge potential for the future, way better and more profitable then the names called above.

Decred (DCR) should be at the top of this list. Its PoS yield is per june 2018 between 15 and 20% annually.

Good afternoon I would like to know if one can stake bit coin cash , bit coin and ethereum. Also is it possible to take daily returns or monthly returns from them ? Im from South Africa and our focus is mainly on mining and I would like to put together a group of altcoin enthusiasts and consider DIY stacking

No, staking for btc,eth, & bch is not possible.

Need to know if there are any masternodes that i can directly purchase instead of setting them up