- What is Wootrade?

- How Wootrade solves the problem of fragment liquidity?

- Should you invest in Woo Token?

We all know that the adoption of the cryptocurrency industry has increased substantially in the last 3-4 years. However, the industry’s adoption, efficiency, and performance are still far from where traditional stock markets are.

The crypto industry is still in the stage of infancy, and we need to address and resolve a number of issues to make it a reliable financial industry. One of the major problems is the fragmented liquidity of crypto assets across the various crypto exchanges and protocols.

Several problems which are faced by the crypto industry at the moment are listed as follows:

- The liquidity of crypto assets is fragment throughout the cryptocurrency industry

- An exchange is considered good or bad by its trade volume size, which leads to a number of problems such as:

- Fake trade volume pumps

- Listing of popular but shitcoins with bad fundamentals

- Other risky products such as extensive margin and leveraged tokens being offered on the exchange

- Prediction products being offered by the exchanges

- Price mismatch on the exchanges is only dependant on the arbitrageurs to close

- Small exchanges have to invest their substantial time and resources in building liquidity for the platform. However, these resources can be used for customer acquisition and platform improvisation.

- The trading fee of crypto exchanges is higher than the traditional stock markets

- Exchanges are unable to attract professional market makers to improve their liquidity

Today, I have brought you a project Wootrade that is focusing on resolving the above issues with a unique strategy and platform.

Page Contents

What is Wootrade?

Wootrade is a dark pool trading platform that provides high liquidity, negligible spreads, and zero trading fees. Wootrade tries to solve liquidity and cost issues of crypto assets for exchanges, institutions, and investors. A dark pool is an Alternative Trading System where traders can interact privately. This helps in improving liquidity and pricing.

Wootrade was established in June 2019 and received its seed funding from Hashkey Capital, Fenbushi Capital, SNZ & DFund. Wootrade is incubated by Kronos Research, which is one of the leading quantitative trading firms and also the initial liquidity provider to Wootrade. Kronos Research was founded in June 2018 and is a Designated Market Maker (DMM) for Binance, HTX, Okex, and many other exchanges.

The smaller exchanges, which collectively handle a significant portion of market trading volume, are stuck with trying to build their internal market-making systems while simultaneously trying to attract a core user base. With the help of Wootrade, these smaller exchanges can delegate the function of market making to Wootrade Alternative Trading System (WATS) and focus on their business growth. Thus, Wootrade can provide these exchanges with a fully functional order book.

Now, let us understand more about the founding team behind Wootrade.

Who are the founders of Wootrade?

Jack Tan – Twitter

Co-Founder

Jack is a co-founder and co-CEO of Kronos Research, a successful quantitative trading firm in digital assets. Jack started trading with equities at the age of 14 and graduated from Carnegie Mellon University. Post-graduation, he worked with BNP Paribas and Deutsche Bank for more than a decade.

Mark Pimentel

Co-Founder

Mark co-founded Kronos Research and acted as co-CEO. He completed his bachelor and masters in Computer Engineering at CMU. Mark started his professional career at Citadel Investment Group’s High-Frequency Trading unit in 2006. Post this; Mark leads Knight Capital’s electronic market development group.

Now, as we know about the foundation team, let us understand the features of Woo Trade platform.

Features of Wootrade

The features offered by Wootrade can be listed as follows:

Woo Dark Pool – Providing liquidity to crypto exchanges

As discussed earlier, Woo Dark Pool is a liquidity pool that exchanges can use to resolve their liquidity issues. The Dark Pool can help small exchanges with their fragmented liquidity and provide them with a ready-made order book.

The exchanges can focus on business growth and leave the function of market making to Woo Dark Pool, also known as WATS (Wootrade Alternative Trading System). Further, Wootrade helps to route CeFi liquidity to DeFi platforms, thus solving their market-making problems as well.

Woo X – A zero-fee trading exchange platform

Woo X is a retail trading exchange platform of Wootrade that offers zero-fee trading. A beta version of Woo X trading platform has already been launch, and the official launch has been planned somewhere in mid-June 2021.

The platform would be offering spot, margin, and futures trading with immense liquidity of Woo Dark Pools along with a zero transaction fee.

Woo Ventures – Identify and invest in early-stage crypto projects

Woo Ventures is a program similar to Venture Capitalist firms that try and identify early-stage projects. As these projects mature, they would provide value to Wootrade and WOO token holders.

The new projects would be benefitted Wootrade as it would provide the project access to its user base. Further, WOO token holders who have staked their tokens would get airdrop rewards for these early-stage projects.

Woo Staking – Earn passive income by staking WOO tokens

A user can stake his or her WOO tokens (in house governance token of Woo platform) to receive a number of benefits, such as:

- Zero trading fee for retail users

- Reduced or zero trading fee for institutions and exchanges

- Asset management strategy investors can earn a discount on the service fees

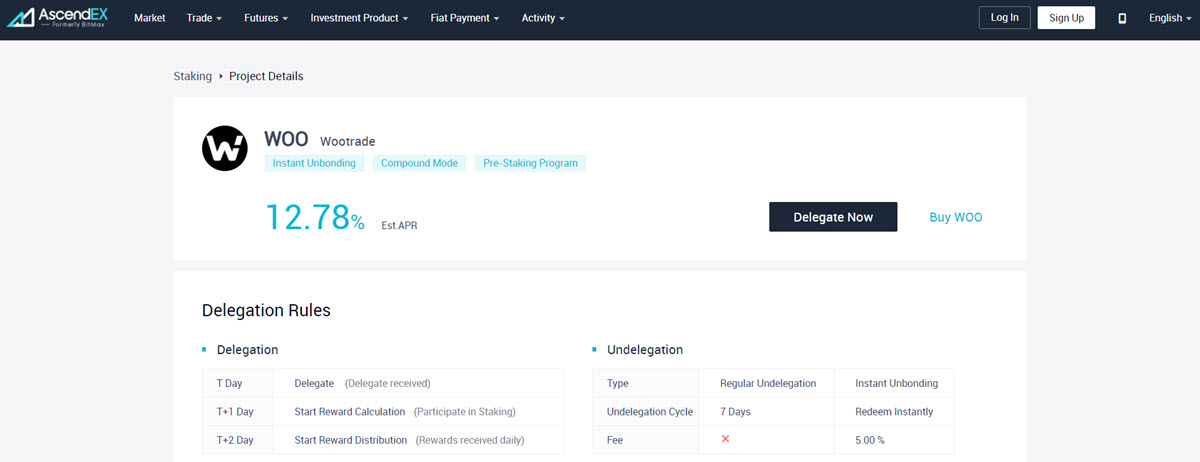

Currently, WOO tokens can be staked on AscendEX with an Estimated APR of 12.78%. Soon, the staking feature would also be active on Woox trading platform.

You can read more on Woo Staking over here.

Features to be added in coming future – Roadmap of Wootrade

As discussed above, Wootrade is in the process of launching its Woox trading platform, and many other features would be incorporated into this platform. The platform would also launch its mobile app for ios and android devices.

WOO Token Utility– Is it worth investing in?

WOO is an in-house governance token of the Wootrade platform. It is an ERC-20 token that can be traded on most major exchanges. Every month WOO tokens are bought back and burned from the revenue generated by the platform.

Although currently, Wootrade platform is centralized, it is expected to become decentralized. After decentralization, the governance of the platform will be managed by WOO token holders. However, the roadmap of decentralization is not clear from the whitepaper.

The platform is gaining momentum, with a Monthly volume trade on the platform in April 2021 was USD 4.5 Billion.

| Criteria | Value |

| Total Supply | 2,992,996,747 |

| Circulating Supply | 443,373,907 |

| Price | USD 1.03 |

| Market Cap | USD 454.6 Million |

| Fully Diluted Value | USD 3.09 Billion |

| Volume (24 Hour) | USD 94 Million |

Use cases of Woo Token

Following are the use cases of WOO token:

- Collateral – WOO token can be used as collateral on the trading platform

- Staking – WOO tokens can be staked in the market, making funds to earn passive income

- Fee Payment – WOO token can be used to pay margin and wealth management fee at a discounted rate.

Exchanges on which WOO token is available:

| S. No. | Exchange | Trade now |

| 1. | HTX | Click Here |

| 2. | Uniswap | Click Here |

| 3. | Sushiswap | Click Here |

| 4. | Gate.io | Click Here |

| 5. | MXC | Click Here |

| 6. | AscendEX | Click Here |

| 8. | Hoo Exchange | Click Here |

You can read more about WOO token here.

What are the benefits of Wootrade?

The benefits of Wootrade can be listed as follows:

- Solves an industry-wide problem of fragmented liquidity

- Zero fee trading platform

- Can solve many other problems of crypto industry such as fake volumes and risky products

- Woo ventures provide an opportunity to invest in early-stage projects

However, there are some limitations as well.

What are the limitations of Wootrade?

The possible limitations of Wootrade are as follows:

- Orion Protocol is a similar platform that has more and better partnerships across the crypto industry. Wootrade would thus have to differentiate itself through product offers. I have talked about Orion protocol earlier on my article about no-KYC exchanges.

- Binance and Coinbase are the existing industry giants who control the substantial part of liquidity in the industry. Wootrade empowers small exchanges by providing them high liquidity. Therefore, Wootrade effectively targets these giants’ market share and market dominance. This can put Wootrade in a business continuity risk.

- The decentralization and community governance system that Wootrade intends to build is not clear from the litepaper. Therefore, the use case of WOO token is not clear because of this reason.

Conclusion – Wootrade Analysis 2021

I understand that Wootrade brings a lot of good and innovative solutions to the table. It aims to solve those crypto market problems which have not yet been identified by most of the market players (except some). Therefore, the project has a definite use case and possible future adoption.

The only thing with which I have a problem is a concrete roadmap for future decentralization of platform and governance module through which WOO token would receive its value. I will try to connect with the development team and would try to answers my questions in this regard. Once I have these answers, I think I would be able to voice my opinion on whether WOO is an investible token or not.

Please note that I am not a financial advisor, and this is not financial advice. DYOR before investing.

I hope this article would provide you a good insight into the Wootrade and WOO Token. Let me know the projects or exchanges that you would like me to review.

Let me know your feedback in the comments section and share this article with your friends and colleagues. Subscribe to our newsletter for more such articles.

Useful Links