APR stands for Annual Percentage Rate and APY stands for Annual Percentage Yield. Both of these are a percentage of the rate of interest that a borrower needs to pay and a lender or investor receives on his or her investment.

The problem is that both these terminologies are sometimes used synonymously, but there is a substantial difference between them. So, let us understand what this difference is.

APR (Annual Percentage Rate)

APR is the annual rate of interest that is paid by borrowers to the lenders (or investors). APR is a simple interest rate and does not consider the compounding of interest. Thus, APR does not consider the frequency at which a particular interest rate is applied.

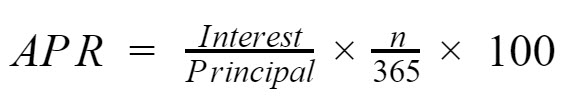

APR is calculated as follows:

- Interest = Interest to be paid over a borrowing

- Principal = Amount borrowed

- n = Number of days for which the amount has been borrowed

The problem with APR is that it may not always show a correct picture to a borrower. It may show an understated amount of interest to be paid by a borrower as it does not consider the compounded value of interest. We will discuss this in detail in the below-mentioned example.

APY (Annual Percentage Yield)

APY is the annual rate of interest which also considers the effects of compounding. In other words, it is the effective annual compounded rate of interest. It lets a borrower or investor know the actual amount if interest to be paid or earned after a year.

n = Frequency at which interest would be compounded i.e. it can be daily, monthly or annually

APY resolves the limitation of APR as it takes compounded interest under consideration.

Example of computation of APR and APY

Let us assume that a BTC savings account offers an interest rate of 5% per month. Then APR can simply be calculated as follows:

APR = 5% X 12 months = 60%

However, in case you deposit USD 1,000 worth of BTC in this account, you would not earn 60% i.e. USD 600. You would earn more.

Now APY, in this case, would be computed as follows:

APY = (1+0.612)12-1=0.795856=79.59%

Which is better? APR or APY?

The difference between APR and APY is non-significant in a short period but it makes a huge difference in the long run. Thus, APY is a better measure of computation of interest as it shows an accurate picture to the borrower and the investor.