If you are here because you have made up your mind to invest in cryptocurrencies, you are in the right place.

Here at CoinSutra, we talk about everything that you need to know and understand in order to get started or level up your cryptocurrency investment game.

We mainly talk about:

- Which crypto coins to invest in

- Crypto Exchanges

- Cryptocurrency Wallets

- Crypto trading

- Crypto Portfolio Tracker Tools and many more things…

But you are thinking about where to start, aren’t you?

Keep your worries aside. We will help you out and tell you exactly what you need to know and do.

Page Contents

How To Invest In Cryptocurrencies – Guide

In 2023, it’s no brainier that you should have some portion of your wealth in crypto assets. Think of cryptocurrency as a new financial system that is more robust and powerful than the legacy financial system. You might be rewarded with spectacular returns, but at the same time, it comes with extra risk.

Cryptocurrency as a whole is regarded as a “High risk and high return” investment, so you should allocate a fixed percentage of your entire asset allocation. According to Fidelity, an investor should have 5% of their portfolio in the crypto assets. However, we at CoinSutra feel, you can have more if you are well-educated and informed about cryptocurrencies. But, for retail investors, 3-5% of their entire net worth in crypto is a decent amount.

Different ways of investing in Cryptocurrency:

There are different ways by which you can get exposure to cryptocurrencies. Let’s discuss some of the top options which are available as of now:

Buy Cryptocurrency directly:

This is the most popular way of getting exposure to crypto assets. You can sign up for any of the top crypto exchanges which are available in your country, and buy the cryptocurrency directly. Most of these exchanges offer in-built crypto wallets, so you don’t have to worry about custody of your investment. However, it is suggested to be a self-custodian of your crypto assets. More on this in the latter part of this crypto investing guide.

Invest in Crypto companies:

Another way you can get exposure to crypto assets is by buying the stocks of crypto companies or companies that have a significant portion of their balance sheet in cryptocurrencies. Micro strategy is one such company that is holding 125,051 bitcoins, valued at about $4.8 billion at the current bitcoin price of $38,700.

Here are a few crypto-companies:

Cryptocurrency mining:

If you are a DIY kinda person, you can mine cryptocurrencies like Bitcoin, Ethereum, and others to earn cryptocurrencies. Mining requires an initial investment in the form of physical equipment, and once it is set up, electricity and maintenance are another cost. Miners help a network by securing it and helping in validating the transactions and thus earning underlying cryptoassets as a reward.

There are more ways like Bitcoin IRA to invest in cryptocurrency. However, the most popular way is by buying the cryptocurrency directly from an exchange.

How Cryptocurrency investing works:

Here is how to invest in cryptocurrency directly:

- Pick an exchange: Find the best crypto exchange for your country, and create an account. Binance is most popular around the globe, Coinbase and Kraken are popular in the USA, WazirX is popular in India, and so on. Depending upon the country you are in, you should create an account on your country crypto exchange, and complete the KYC to be investment ready.

- Add funds to your account: Next step is to add funds to your crypto exchange. This will be your local currency, which you will be exchanged for cryptocurrency. If this is your first time, start with a small amount like $100 or $1000.

- Make a list of cryptocurrencies to buy: Now, it is time to make a list of cryptocurrencies that you should buy. If you are just getting started, most people buy only Bitcoin and Ethereum which are the two most popular cryptocurrencies. However, you can research more and make a list of low-valuation and high-growth probable altcoins that you could buy.

- Place buy order: Buy the cryptocurrency that you have selected. It is suggested that 40-50% of your portfolio should be in blue chip companies like Bitcoin and Ethereum. The reason is, when the market tanks, they will help you give stability to your crypto portfolio.

- Move crypto to digital wallets: You could use the crypto exchange to store your cryptocurrencies. But, we recommend it to move crypto to your own crypto wallet. If you have invested more than $1000, then invest in a hardware wallet like Ledger Nano X, which will ensure the maximum safety of your digital assets.

Suggested read: Things not to do after investing in Bitcoin and Cryptocurrencies

Cryptocurrency investing

The first thing you need to know is which projects you are investing in. There are over 21000+ tokens and coins out there, and this could be overwhelming for a new user like you. Another aspect is, do you want to make money by investing or you want to ape in other aspects of crypto assets returns.

Note: Like it or not, 98% of cryptocurrencies are scams. So, you have to be very careful with Crypto investing, or else you will only be gambling with your money.

This extra aspect is highly recommended, as you would be able to increase your investment by 20-150% by doing some basic stuff, such as:

- Providing liquidity mining

- Participating in proof of stake

- Lending your stablecoins on Defi lending protocol

- Automated Bot trading

You see, multiple avenues are available in the world of crypto assets to make life-changing money. But it all starts with self-learning, and spending time reading and using the crypto assets platform that you are investing in.

Before talking about investing directly, we need to talk about the historical perspective of cryptocurrencies that will help you more in appreciating this invention.

Is Cryptocurrency a good investment?

Cryptocurrencies are a risky investment and highly volatile. The price could increase and decrease significantly and could cause anxiety to many investors. From the ROI perspective, cryptocurrency could help someone make life-changing money, which comes after spending a significant amount of time learning the nuances of crypto investing.

What is the minimum I could invest in cryptocurrency?

One can invest as minimum as $1 in cryptocurrency.

Can you get rich investing in cryptocurrency?

It is no hidden fact that a lot of people have become ultra-rich by investing in cryptocurrency. It is not widely known that a lot of users have lost their hard-earned money in cryptocurrency. Especially, people who have bought cryptocurrency in the hype cycle or when crypto is at an all-time high, have lost money or are stuck with their investment. Knowing which cryptocurrency to buy and when to buy is the most important skill that you need to build.

Is there any paid course for learning how to invest in cryptocurrency?

Yes, one can join CoinSutra VIP to learn crypto investing in a systematic way. https://vip.coinsutra.com is the web address of CoinSutra VIP.

History Of Cryptocurrencies

This goes back to the global 2008 Financial Crisis and when you talk about it, you can’t avoid it without mentioning Bitcoin.

In the month of October 2008, a paper was published on The Cryptography mailing list by an anonymous guy under the pseudonym “Satoshi Nakamoto“. Until today, the real identity of Satoshi Nakamoto is unknown but there are some fun facts on Satoshi Nakamoto which you can read here.

Bitcoin was invented to put a full stop to insidious modern-day banking and to create an alternative for people who wanted to opt out of the banking system.

It was not a mere coincidence that Satoshi created and announced Bitcoin just after the financial crisis of 2008. In my opinion, and in the opinion of several other tech economists, it was an all-out attack on the central banking system, a system that has become incompetent as well as insidious.

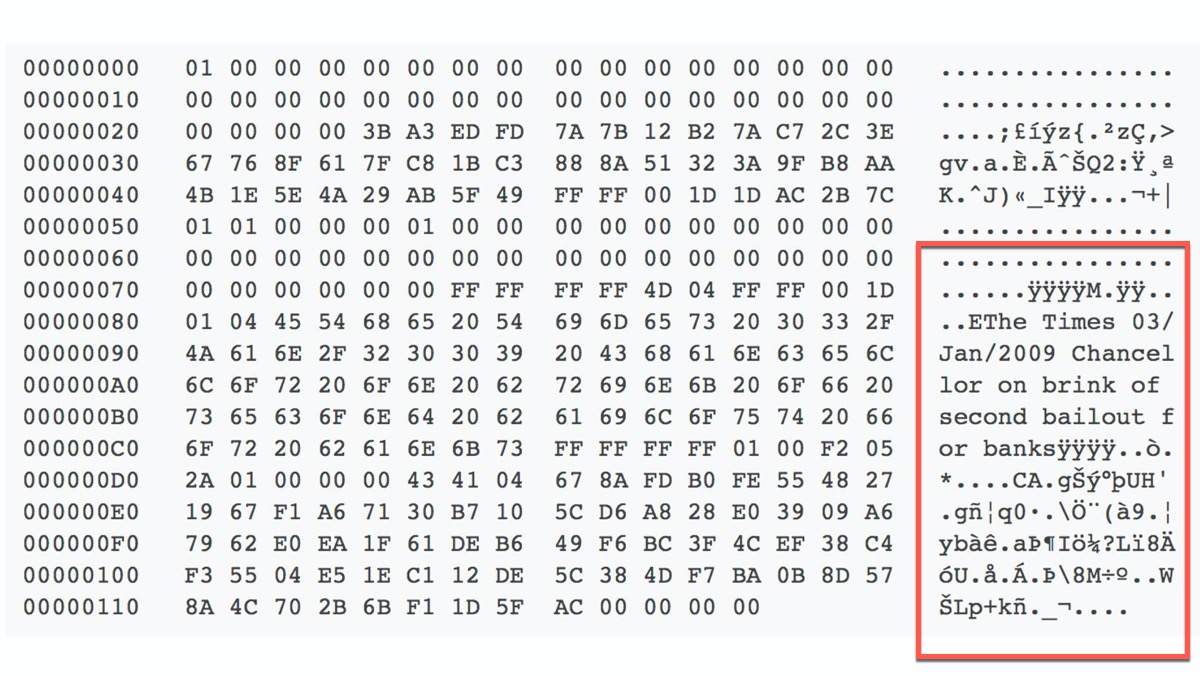

Satoshi Nakamoto-labeled text on the Bitcoin genesis block clearly indicated that after the 2008 bailout of banks, the crisis would hit soon again. The text of the label was “03/Jan/2009 Chancellor on brink of the second bailout for banks”.

#Bitcoin haven't experienced any major Financial Crisis yet.

— CoinSutra – Best Crypto Resources (@CoinSutra) June 15, 2019

Bitcoin was actually created to provide people the alternative to modern-day banking and saving them from the inflationary policies of corrupt governments. It was also created to show the world that decentralized trust can be created if backed by solid mathematical models – cryptography.

Hence, Bitcoin, the world’s first cryptocurrency, was created.

Since then, this space has progressed by leaps and bounds. Today, we have more than 2200 cryptocurrencies around us. If you don’t trust me, take a look at the number of coins listed on CoinMarketCap.

Get Your Mind Set For A Roller-Coaster Ride

Important: Crypto isn’t for the weak-hearted. Don’t blame me later for not warning you.

If you are getting into the crypto world, be prepared for a roller-coaster ride because it is a wildly volatile asset class. From investment perspective, it is a high-risk high-reward investment.

If you can’t handle a drop of 80% and then ride a wave up to 200-300%, this is not the place for you.

Also, if you think you will reap benefits to the tune of 300-400% on your investment in a matter of days, you are grossly mistaken. There are no guarantees, and a lot will depend on your knowledge, risk appetite, and luck.

| Year | Price at the Start of the Year | Price at the end of Year | Growth in % |

| 2010 | $0.0015 | $0.31 | 20566% |

| 2011 | $0.31 | $6.18 | 1893.5% |

| 2012 | $6.18 | $13.44 | 117.5% |

| 2013 | $13.44 | $751 | 5487.8% |

| 2015 | $285 | $435.7 | 52.8% |

| 2016 | $435.7 | $952.5 | 118.5% |

| 2017 | $952.5 | $2586 (To date) | 171.57% |

| 2018 | $952.5 | $19,535 | 1950% |

But you know what, I deliberately missed one year: 2014.

In that year, Bitcoin prices plummeted, incurring a 62% loss to investors. Also, Ever since the start of 2018, Bitcoin has lost its 69% value. This is just to give you a fair idea of what you are getting into.

Also read: What Volatility Means In The Bitcoin & Cryptocurrency World and Why it’s not too bad for it

Never Invest More Than What You Can Afford To Lose

That is the basic rule of any investment. Never invest more than what you can afford to lose.

I am saying this because I have witnessed first-hand the wild volatility of this market and know quite a few people who have a lost a lot by investing more than what they can afford to lose.

If you don’t follow these basic investing principles, you may end up like some of these people:

I took out a $75,000 mortgage, put it all in bitcoin (at $19,442) and right now I have $48,639 left!!!! WTF!!! DO I SELL OR KEEP HOLDING!?!?!

— 🤝 (@ProudMoolie) December 22, 2017

Got thousands of people to believe I took out a mortgage to buy bitcoin, lost it all, and still nobody sent anything to my wallet. Fuck y'all

— 🤝 (@ProudMoolie) December 22, 2017

I lost $30,000 the past 3 hours. I’m getting evicted. Fuck crypto

— 🤝 (@ProudMoolie) December 22, 2017

This all not to scare you. Instead, this is to warn you about the wrong mindset people have which results in losing a lot of money.

Don’t Fall For Scams

Usually, people are lured by the fact that crypto is a get-rich-quick scheme and there would be LAMBOS (a funny acronym used for Lamborghinis in crypto space).

But is that really true?

Yes, it is. Early investors have already made a huge amount of money.

And out of these super-rich guys, some will launch their own crypto MLM scams just like Amit Bhardwaj, who scammed many people of millions of dollars.

That’s why you need to learn how to discern common cryptocurrency scams and invest only in high quality projects. You also need to pick only high-quality websites for buying/selling cryptocurrencies. (We have got you covered here on CoinSutra)

(Read: 7 Most Common Types Of Cryptocurrency Scams & Tips to Avoid Them)

This brings us to the next topic of finding coins that have a use case as well as decent chances of price appreciation.

Invest in Unicorn coins

Do you know our habits?

We don’t invest in coins that we haven’t researched.

Having said that, we don’t gamble and always do a thorough fundamental analysis of prospective coins that we think are worth buying/selling.

And so far so good, all the coins that we have covered on CoinSutra are doing pretty well.

That doesn’t mean you should blindly follow us as we are not your investment advisors. But we can give you a head start in the right direction.

So far we have covered more than 20 cryptocurrencies that we believe have a good use case. Here they are:

The thing is you should make your own list of projects that you are interested in. Spend time reading, learning, and using the platform. If you think practically, you just need 5-6 projects that could help you earn life-changing money, but the path to that is not simple. You need to be reading and learning all the time, and you need a system that helps you in risk management.

Find Out Reliable Exchanges If You Don’t Want to Lose Your $$$

Fake and unreliable crypto exchanges are the most common cryptocurrency scams you will see happening in this space.

A lot of newbies end up signing up for good-looking websites that offer free $100 or so, and later shut down, which is typically known as an exit scams. So this is one area, you need to be particularly careful about.

Check out: Best Cryptocurrency exchanges

Also, you will find that exchanges without proper security measures are sure to get hacked sometime or the other.

Here are the testimonials of the top 5 Biggest Bitcoin Hacks Ever that speak for themselves.

Confused?

Well, anyone would be because exchanges are the first point of contact from where we buy/sell cryptocurrencies. That is why one needs to pick them carefully.

For this task, you can rely on CoinSutra as we thoroughly vet crypto exchanges before using them ourselves and recommending to our audience.

Here is the recommended list of exchanges:

- Binance: Offers mobile app and probably the fastest growing exchange. If you need to pick only one, this is the best and #1 in 2020. You can directly buy cryptocurrencies, and also trade.

- ByBit: The whale of cryptocurrency exchanges. You can do margin trading if that’s your thing.

- Binance futures: For Futures trading.

- Kraken: One of the strongest U.S. based exchanges that also offers a mobile app. They have been constantly updating their mobile app to make it one of the best in the industry.

- Wazirx: For users from India.

For Buying cryptocurrencies using credit/debit cards.

- CEX: My favorite

Read: How to buy Bitcoin for first-timer

Now that you know where you can get your cryptocurrencies, it makes sense in talking about what you can do with these to maximize your profits.

Profit-Making Strategies In Crypto

Once you get hold of your cryptocurrencies depending upon its category you can do a lot many things to maximize your profits.

Some of these strategies are:

- Buying & HODLing

- Buying & Holding Cryptocurrencies For Dividends

- Stake Cryptocurrencies

- Run Masternodes

- Day Trading Cryptocurrencies

- Airdrops: Cryptocurrencies Airdrops- Everything You Need To Know

- ICOs (beware of ICO scams):5 Tips For Beginners Before Investing In ICOs

- Mining (Not feasible for general investors, the initial investment and tech know-how is high)

There are various methods of earning profits by investing in cryptocurrencies, and the same has been discussed in detail in our guide Top Ways To Earn Money From Cryptocurrencies.

Last Rule:

Lazy Enough To Ignore Crypto Security: Better Don’t Invest

If you are too lazy to follow the basic standards of online digital security, crypto isn’t your field.

- Have good HD wallets

- Use a Hardware wallet like Ledger Nano X if you are storing large sums. This device cost about $149 but is worth every penny.

- Have 2-FA authentication On Mobile Always

- Password Managers like Dashlane

- Use VPN with No logs

- Firewalls & Antivirus

- Seed key back-up

- PIN code and Passphrase protection etc…

Also, always use the best wallets that allow you to control your funds and avoid using hosted wallets where you don own your private keys. It is so because:

If you don’t own your private key, you don’t own your cryptocurrencies.”

Also, learn about basic security tenants here, here, and here because we have written these only for you.

Another reason to start investing in cryptocurrency:

Cryptocurrency is a growing industry, and it has a lot of financial structure which is similar to the traditional one. Even if you are someone who doesn’t understand the traditional financial system, being in cryptocurrency will help you to understand this.

Needless to say, your blood must be pumping, and you might be all set to start cryptocurrency investment. However, it’s for your own best interest, that you wait for a few days, spend time learning and understanding the whole ecosystem of Cryptocurrency, and then start investing.

The first thing you should understand is “What is Bitcoin” and why this first crypto coin has created an industry around it.

Portfolio Management Is A MUST In Crypto!!

All set:

Now, you have picked the winning projects, learned the security measures and picked the right wallet. But one thing is still left…

Any guesses?

Well, no prizes for this, as now the only thing left is how to track your investments and get insights on your profit/loss status as the market is always moving.

That’s where you will need a crypto portfolio management tool.

- Investors can use something as simple as CoinTracking

There are plenty more, but these two will serve your purpose well. However, if you are extra choosy, don’t forget to take a look at our exclusive list of Best Cryptocurrency & AltCoins Portfolio Management Apps

Over time you will also learn about:

- Asset allocation

- Rebalancing

- Portfolio diversification

These things will ensure that you maintain a discipline like pro-investor, and enjoy the benefits of crypto investing.

Self-Eduction Is The Key To Monetary Sovereignty

Crypto is all about your own monetary sovereignty by being your own bank. If you are not up for it yet, educate yourself more on this until you get it.

Because if you get hacked or lose your money, no one else is to be blamed other than you. But that doesn’t mean you should get scared and do nothing.

Instead, I would say start small and try to grow from there.

- Be Up to Date

Always keep a tab on news and rumors because the crypto market is highly influenced by that. Doing this will help you make better strategies for buying/holding/selling particular crypto.

- Don’t Over Do

Don’t spoil your health by sticking to your laptop for 24 hours. Instead, stick to a model and follow that regularly for successful investment habits.

- Teach Others

Going back to why it started:

It started to free people from the banks and traditional financial system. So if people don’t learn about this new approach to money, i.e. cryptocurrencies, it would probably fail.

Therefore, extend a hand to help people learn about it so that cryptos can thrive.

- Bonus****

Last, but not least, there are some bonus tools and services that will help you in monitoring price, development status, news, the potential of a coin, and volatility of various coins throughout your investment journey.

Lastly, if you like what we do here at CoinSutra, do give us a shoutout in your own community of wonderful human beings who are interested in cryptocurrencies.

Adios!!

Further suggested readings from CoinSutra:

- How to Invest in Bitcoin

- 9 Must Watch Blockchain Videos For Beginners

- How many Bitcoins are there in circulation

- How to get a Bitcoin address

Help us improve. Was this helpful

About Harsh Agrawal :

An award-winning blogger with a track record of 15+ years. He has a background in both finance and technology and holds bachelors degree in Information technology and engineering.

An international speaker and author who believes in the future of blockchain and the applications of the crypto world.

Join us via email and social channels to get the latest updates straight to your inbox.

Expertise:

Harsh has 15+ years of experience in Fintech and 7+ years in Blockchain and Bitcoin. He has also moderated the panel of Blockchain experts and attended international blockchain events like BTCMiami, Mainnet Messari, and Token2049.