There are several ways to buy Bitcoins, but nothing is as easy as buying it from your bank account.

I know it sounds absurd when I say that you can buy bitcoins using a bank account because the concept of Bitcoins is contrary to what banking is.

However, if you ignore that fact for a moment, you can get your bitcoins if you have a bank account.

Plus, it is less risky for the seller to sell BTC by receiving fiat directly into bank accounts than dealing with chargeback frauds of credit/debit cards.

Page Contents

How To Buy Bitcoin With Bank Transfer

Some services around the world allow you to deposit fiat in their accounts for BTC in return. Such services have fiat linked crypto accounts, and almost all of them provide an inbuilt BTC wallet too, where they give you the bitcoins.

Let’s look at such services and what they offer.

1. Cex.io

CEX.io is an old cryptocurrency exchange service operational since 2013, from London, UK. The list of cryptocurrencies available on the platform includes Bitcoin, Ether, Ripple, XLM, Bitcoin Cash, Dash, Zcash, and Bitcoin Gold.

- Servicing Countries: All countries supported except a few. (Deposits/Withdrawals)

- Supporting Fiat: EUR, USD, and RUB

- AML/KYC Requirements: Mandatory AML/KYC is required

- Fees Structure: CEX.io follows the maker & taker fee schedule as shown below:

2. Coinbase

Coinbase is a popular name in the world of cryptocurrencies and is a digital currency exchange in operation since 2012. It is a broker exchange that serves 32 countries with four digital currencies including BTC.

- Servicing Countries: Coinbase serves 32 countries.

- Supporting Fiat: USD, EUR, GBP (via SEPA)

- AML/KYC Requirements: Mandatory AML/KYC is required

- Fees Structure: 1.5 % and other fiat withdrawal fees.

Here is a complete step by step guide on how to purchase BTC from Coinbase: How To Buy Bitcoin Using Coinbase.

3. Exmo

EXMO Finance LLP established in England, UK is running EXMO exchange for some time now and has a diverse team of developers and financial advisors from Spain, Russia, India, Thailand, Great Britain, USA, Lithuania, and Singapore.

- Servicing Countries: +100 countries except for China, Middle East Countries & North Korea

- Supporting Fiat: EUR, USD, PLN, RUB, UAH

- AML/KYC Requirements: Verification is mandatory to deal with fiat.

- Fees Structure: 0.2% flat trade fee and fiat fee schedule is here.

4. Bitfinex

Bitfinex is a cryptocurrency exchange operating from Hong Kong since 2012. It is also one of the busiest exchanges in terms of USD volume for BTC.

- Servicing Countries: Bitfinex serves all countries except the United States, Bosnia and Herzegovina, Democratic People’s Republic of Korea (North Korea), Ethiopia, Iran, Iraq, Syria, Uganda, Vanuatu, and Yemen.

- Supporting Fiat: USD, EUR, GBP, JPY

- AML/KYC Requirements: KYC is mandatory.

- Fees Structure: It follows the maker & taker fee schedule as shown below:

5. GDAX

GDAX is an order book marketplace for cryptocurrencies owned and maintained by Coinbase.

- Servicing Countries: GDAX currently operates in the US, Europe, UK, Canada, Australia, and Singapore.

- Supporting Fiat: USD, EUR, GBP

- AML/KYC Requirements: Mandatory AML/KYC is required

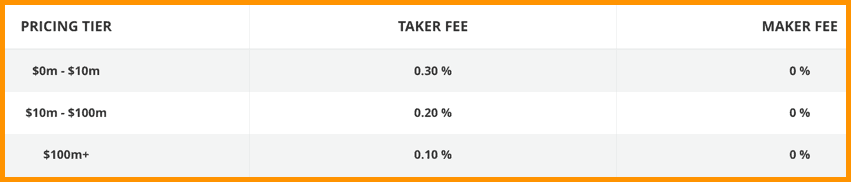

- Fees Structure: It follows the maker & taker fee schedule as shown below-

6. Bitstamp

Founded in 2011, Bitstamp is a bitcoin exchange based in Luxembourg. It allows trading between USD currency and bitcoin cryptocurrency. It allows USD, EUR, bitcoin, litecoin, ethereum, ripple, or bitcoin cash deposits, and withdrawals.

- Servicing Countries: Available worldwide

- Supporting Fiat: USD & EUR

- AML/KYC Requirements: KYC is mandatory to deal with fiat.

- Fees Structure: It has maker & taker fee model; see fiat fee schedule here.

7. Coinfloor

Coinfloor is a London-based Bitcoin exchange functioning since 2013 and is run by an experienced team as elucidated here. On Coinfloor, a UK resident can easily buy Bitcoins after a KYC, using fiat currencies such as GBP, EUR, USD.

- Servicing Countries: UK

- Supporting Fiat: GBP, EUR, USD

- AML/KYC Requirements: KYC is mandatory to deal with fiat

- Fees Structure: Exchange & withdrawal fees are below:

8. Livecoin

- Servicing Countries: All countries except few

- Supporting Fiat: EUR, USD, RUR

- AML/KYC Requirements: KYC is mandatory to deal with fiat.

- Fees Structure: The trading fee is decided based on your trading volume.

9. Kraken

Kraken is a US-based cryptocurrency exchange operating in Canada, the EU, Japan, and the US, since 2011, and is the world’s largest bitcoin exchange in euro volume and liquidity.

- Servicing Countries: US, Europe, Japan, Canda

- Supporting Fiat: USD, EUR, JPY, CAD

- AML/KYC Requirements: Yes, KYC is required

- Fees Structure: Fiat fees schedule is stated below; here are the trading fee details.

10. Bithumb

Bithumb is a Korean cryptocurrency exchange with enormous liquidity on its platform.

- Servicing Countries: South Korea

- Supporting Fiat: KRW

- AML/KYC Requirements: Yes, AML/KYC is required

- Fees Structure: 0.15% trading fees

11. CoinSpot

CoinSpot is Australia’s native Bitcoin exchange operating in this space since 2013. If you are an Australian, it is effortless to start on CoinSpot as verification barely takes any time, and one can easily buy/sell BTC on it.

- Servicing Countries: Australia

- Supporting Fiat: AUD

- AML/KYC Requirements: Yes, KYC is required

- Fees Structure: The fee for buying and selling coins is 1% (Instant buy) and When buying or selling on the BTC markets, the fee is 0.25%.

Conclusion: Buy Bitcoin Anywhere

| Exchange Name | List Of Supported Fiat Currencies |

| Cex.io | EUR, USD, and RUB |

| Coinbase | USD, EUR, GBP (via SEPA) |

| Exmo | EUR, USD, PLN, RUB, UAH |

| Bitfinex | USD, EUR, GBP, JPY |

| GDAX | USD, EUR, GBP |

| BitStamp | USD & EUR |

| Coinfloor | GBP, EUR, USD |

| Livecoin | EUR, USD, RUR |

| Kraken | USD, EUR, JPY, CAD |

| Bithumb | KRW |

| CoinSpot | AUD |

To conclude, Bitcoin is the oldest cryptocurrency, and over the years it has become easy to buy Bitcoin from anywhere in the world (except few countries).

But, you need to find out reliable services to buy Bitcoin because scams in this space are not a new thing.

Lastly, quick head-ups from our side: Never store your bitcoins in any of the services because these are all hosted by third-party services. Instead, use Bitcoin hardware and software wallets such as Ledger Nano X, Trezor, and Exodus for the same.

If you have some questions or doubts about these listed services, ask away in the comment section below 🙂

Here are a few other articles for you to read next:

- Best Ways To Convert Bitcoins To Cash [Fiat]

- Buying Bitcoins In Australia: The Complete How-To Guide

- Bittrex Alternatives: Exchanges Similar To Bittrex

- Binance Exchange Review: Is It Safe And Reliable?

- 3commas Review: Is it Safe? How do 3Commas works?

With the myriad of cryptocurrencies, exchanges and blockchains flooding the virtual finance landscape, the range of choice available for newbie investors is mind-boggling and one is not only spoiled for choice, but also confused.

I find Coinbase to be a safe haven for my hard-earned widow’s mite of bitcoin satoshi’s. Your regular articles present a plethora of interesting, informative and educative snippets of advice on various ‘coins’ on the market, but if one is to follow them there is the danger of spreading ones crypto portfolio too thinly, as well as being in danger of becoming a jack of all trades, but master of none.

I may invest in some Ethereum at some stage, but my priority now has to be to concentrate on building up my petty stash of prototype Bitcoin, before even thinking of adding anything else. the average on-the-street investor like me doesn’t have that much spare cash to play around with to be able to put any reasonable amount on into more than a couple of different crypto offerings.

Hello Harsh,

How can an individual in India sell their cryptocurrency and withdraw the fiat once the banks are not allowed to do business with the exchanges?

I look forward to seeing more over the counter cryptocurrency exchanges. Eventually I think these will start popping up more and they present a great business opportunity. Another thing I want to see are more functional decentralized exchanges. These might be a ways off, but I think they fit in well to the whole theme of decentralization. They might not ever be able to offer everything a centralized exchange can, but I think they will be important to the future of the market.

I am a relatively new user and currently use Coinbase for usd bank transfers. I use the NanoS to store my coins. I have some bitcoin, eth, xrp, , litecoin and dog chain. I would like to buy some other altcoins that I can store on my NanoS. But Coinbase only offers a few different coins. I found Kracken difficult to navigate. Which exchange is the easiest to buy from, in usd fiat or bitcoin? I have s jaxx account but the built in shape shift doesn’t have the coins I want. I usually transfer to jaxx then to NanoS because I know how.

What should I do. Geoff

Geoff, please try Cex.io they have many coins.

Glidera is another choice. I’ve been using them for a year and a half now. They also integrate with the bitpay wallet.